In the annals of history, the 21st century stands as a testament to unparalleled change. With each passing moment, the world metamorphoses, and with it, the expectations of its denizens. In this relentless march forward, adaptability becomes not just a virtue but a necessity. Just as businesses pivot to meet the evolving demands of consumers, so too do the guardians of our monetary systems—the central banks.

At the forefront of this monetary evolution lie Central Bank Digital Currencies (CBDCs), a technological leap poised to redefine the landscape of finance. As these digital currencies emerge from the cocoon of theoretical discourse into tangible realities, the World Economic Forum’s recent article, from the 6th of February 2024, sheds light on a crucial dichotomy: the distinction between retail and wholesale CBDCs.

Retail vs. Wholesale CBDCs: Deciphering the Contrast

At the heart of the distinction lies their intended audience. Retail CBDCs cater to the general populace, offering a digital alternative to traditional currency. Conversely, wholesale CBDCs find utility within the corridors of financial institutions, facilitating interbank transactions and securities dealings.

While both variants serve as conduits for financial transactions, their operational mechanics and strategic implications diverge significantly. Retail CBDCs, by virtue of their direct engagement with consumers, carry the promise of democratizing finance and fostering greater financial inclusion. The Bahamas, Jamaica, Nigeria, and the Eastern Caribbean Currency Union stand as vanguards in this paradigm shift, having already embraced retail CBDCs to varying degrees.

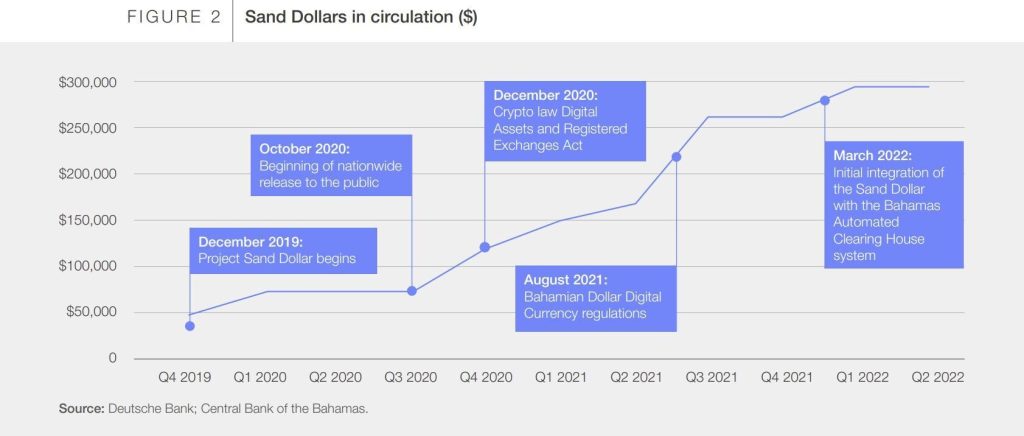

In the Caribbean nation of the Bahamas, the advent of the Sand Dollar—a digital counterpart pegged to the US dollar—ushers in a new era of financial accessibility, particularly for the unbanked segments of society. This pioneering initiative underscores the transformative potential of retail CBDCs in augmenting financial resilience and inclusivity.

Across the Pacific, Asia-Pacific nations spearhead the charge towards digitalization, fueled by burgeoning demand for cashless transactions and the ubiquity of e-commerce platforms. China’s trailblazing e-CNY pilot program, coupled with the Bank of Thailand’s foray into retail CBDC experimentation, exemplifies the region’s proactive stance in embracing fintech innovation.

Wholesale CBDCs: Pioneering Cross-Border Financial Integration

Conversely, wholesale CBDCs traverse a more specialized domain, catering primarily to institutional players within the financial ecosystem. Facilitating seamless interbank settlements and cross-border transactions, wholesale CBDCs offer a glimpse into the future of international finance.

Canada’s Project Jasper, South Africa’s wholesale CBDC pilots, and Switzerland’s groundbreaking bond settlements underscore the global momentum towards leveraging CBDCs to streamline cross-border financial operations. The Bank for International Settlements’ (BIS) collaborative endeavors, culminating in the successful m-CBDC pilot, herald a new era of interoperable digital currencies poised to transcend geopolitical boundaries.

Forging the Path to Interoperability: A Prerequisite for Success

Yet, the realization of CBDCs’ full potential hinges upon a foundational pillar: interoperability. Just as the internet thrives on standardized protocols, so too must CBDCs adhere to universal interoperability standards to facilitate seamless cross-border transactions.

As central banks deliberate over the adoption of retail or wholesale CBDCs, the imperative of interoperability looms large, promising to unlock unprecedented synergies between disparate monetary systems. The European Central Bank’s explorations into distributed ledger technology and the New York Federal Reserve’s wholesale CBDC prototypes exemplify the global quest towards fostering interoperability.

In the crucible of innovation, where the future of money takes shape, one truth remains immutable: utility breeds adoption. As with any technological innovation, the ultimate litmus test for CBDCs lies in their capacity to engender trust, reliability, and convenience—a trinity of virtues that resonate universally across borders and cultures.

In the vast panorama of human history, the emergence of Central Bank Digital Currencies stands as a testament to humanity’s ceaseless quest for progress. Whether heralding a new era of financial inclusion or catalyzing cross-border financial integration, CBDCs embody the vanguard of monetary evolution—a beacon illuminating the path towards a more connected, inclusive, and prosperous future.

Referrence:

https://www.weforum.org/agenda/2024/02/wholesale-retail-cbdcs-difference/