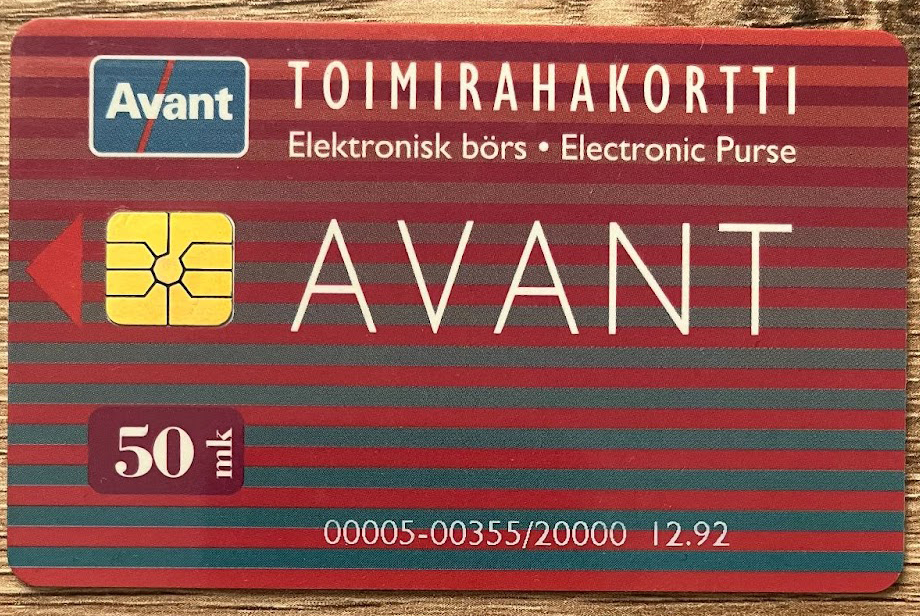

In a landmark move, the Bank of Finland presented a groundbreaking plan for central bank-issued electronic money, also known as central bank digital currency (CBDC), as early as 1991. This innovative proposal, dubbed “Avant,” aimed to revolutionize the payment landscape by introducing a digital equivalent of cash.

The Avant plan was meticulously crafted to emulate cash’s ease of use, anonymity, and widespread acceptance while maintaining low operating costs. The proposed payment card would store monetary value directly on the card itself, eliminating the need for intermediary bank accounts.

Merchants would accept payments by swiping the Avant card through their terminals, instantly deducting the transaction amount from the card’s balance and crediting the terminal’s balance. Merchants would periodically redeem their accumulated balances from the Avant issuer, seamlessly transferring the equivalent amount to their bank accounts.

To safeguard user privacy, the Avant system would not track individual transactions, instead only adjusting balances after each transaction. This approach mirrored the privacy-preserving nature of cash transactions.

The Avant plan’s impact extended beyond the immediate payment experience. It carefully considered the implications for seigniorage income, a central bank’s profit from issuing currency, and its potential impact on monetary policy transmission and financial stability.

While the Avant project never materialized into a concrete implementation, it marked a pivotal moment in the exploration of CBDCs. Its principles and design considerations continue to influence the development of modern CBDC initiatives worldwide.

The Bank of Finland’s foresight in envisioning a digital form of cash decades ago underscores its commitment to technological innovation and its dedication to serving the evolving financial needs of society.