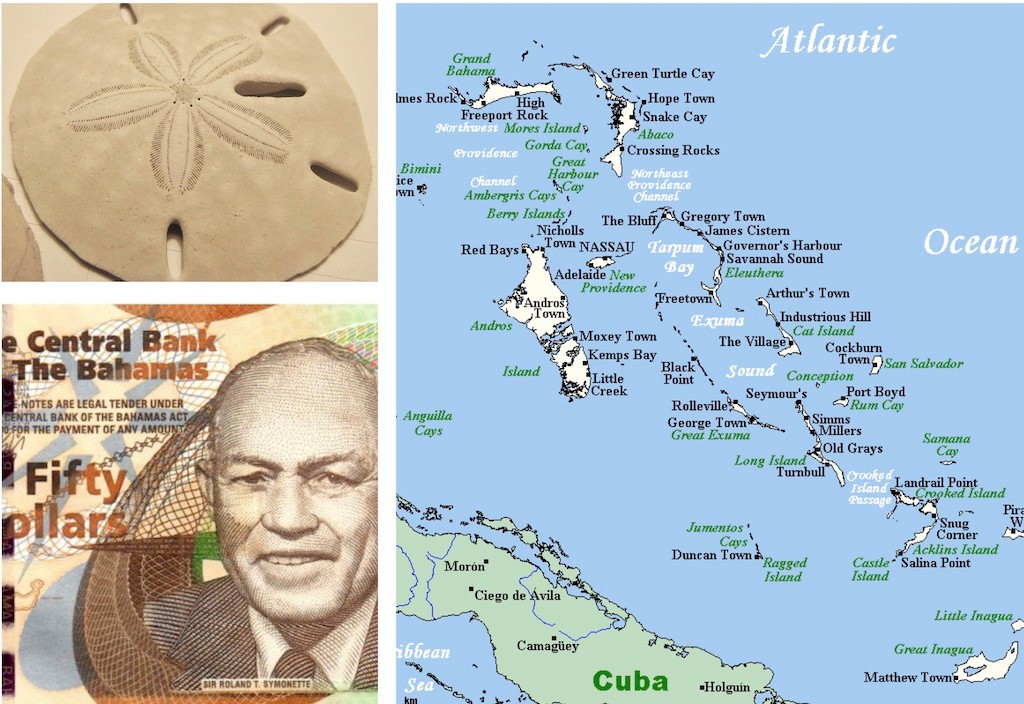

As The Bahamas boldly steps into the realm of digital currency with the Sand Dollar, the Central Bank meticulously navigates the intricacies of monetary policy and financial stability. This article delves into the vigilant measures taken to ensure that the Sand Dollar not only thrives as a digital alternative but also safeguards the foundation of the nation’s financial ecosystem.

“Beyond Transactions: Navigating Financial Stability in the Sand Dollar Era”

Explore the nuanced landscape of monetary policy and financial stability as The Bahamas pioneers the Sand Dollar. This piece unravels the Central Bank’s foresighted approach, surpassing traditional safeguards, to address concerns ranging from potential competition with banks to cyber threats and large-scale fund shifts.

“Risk Mitigation in Motion: Safeguarding The Bahamas’ Financial Landscape with Sand Dollar”

In the age of digital currencies, risk looms large. Discover how The Bahamas’ Central Bank employs strategic design factors to mitigate monetary policy and financial stability risks associated with the Sand Dollar. From imposing limits on currency holdings to real-time monitoring, delve into the comprehensive framework crafted to ensure stability.

“Sand Dollar Symphony: Harmonizing Digital Innovation with Financial Stability”

Embark on a journey through the symphony of monetary policy and financial stability as The Bahamas introduces the Sand Dollar. This article explores the delicate balance struck by the Central Bank, addressing concerns of digital currency competing with traditional banking services and potential disruptions to the financial sector.

“Safeguarding Sand Dollar: The Bahamas’ Proactive Approach to Financial Stability”

Dive into the proactive measures adopted by The Bahamas’ Central Bank in the face of potential financial instability. From limiting digital currency holdings to deploying real-time monitoring and circuit breakers, this article unveils the intricate web of safeguards woven into the Sand Dollar’s fabric, ensuring a resilient and secure financial future.

Fortifying the Financial Horizon: Sand Dollar’s Shield for Monetary Policy and Stability”

As The Bahamas charts its course into the digital frontier with the Sand Dollar, the Central Bank stands guard against potential disruptions to monetary policy and financial stability. In this exploration, we unravel the multifaceted strategies in place, surpassing conventional measures to safeguard the nation’s economic backbone.

Strategic Considerations: Beyond the Basics

The Sand Dollar initiative not only aims at reshaping financial transactions but also acknowledges the nuanced challenges that could arise. The Central Bank’s vigilance extends beyond conventional customer due diligence and transaction monitoring, delving into areas such as money laundering, terrorism financing, tax evasion, and the potential impact on traditional banking services.

Competition and Resource Allocation: A Delicate Balance

A paramount concern is the potential competition between the Sand Dollar and traditional banking services. The fear is that the digital currency might function as a deposit alternative, diverting resources away from licensed financial institutions. The Central Bank recognizes this delicate balance and the risk of having to reallocate domestic resources. To mitigate this, limits will be imposed on the amount of Sand Dollars that individuals, businesses, and non-supervised financial institutions can hold.

Interest, Transactions, and Financial Inclusion

The question of whether Sand Dollar holdings would earn interest adds another layer of complexity. The Central Bank, adhering to its policy objectives, ensures that digital currency doesn’t operate as a substitute for traditional banking deposits. Limits on holding amounts and the requirement for personal digital wallets to be linked to domestic financial institution accounts further reinforce this stance.

Financial Inclusion as the North Star

In the pursuit of financial inclusion, Project Sand Dollar endeavors to balance accessibility with prudence. While individuals can possess mobile wallets without a bank account, businesses are mandated to link all wallets to established bank accounts. This strategic move not only fosters financial inclusion but also differentiates digital currency holdings from traditional deposits.

Real-Time Monitoring and Circuit Breakers: Anticipating Threats

To address concerns related to the speed of electronic transfers, the Sand Dollar infrastructure incorporates real-time consolidated transactions monitoring. This provides early warnings of critical threats to individual banks’ liquidity. In extreme cases, circuit breakers will be deployed to prevent systemic failures or runs on bank liquidity, fortifying the financial sector against potential disruptions.

Conclusion: A Proactive Stance

As The Bahamas strides into the digital future, the Sand Dollar not only redefines transactions but also exemplifies the Central Bank’s proactive stance in fortifying the financial landscape. The delicate equilibrium between innovation and stability is meticulously maintained, ensuring that the Sand Dollar becomes a symbol of progress without compromising the pillars of monetary policy and financial resilience. The journey unfolds, and The Bahamas leads with a vision—innovation with a vigilant eye on stability.