In a groundbreaking move to promote financial inclusion and efficiency, in 2020, the Central Bank of The Bahamas embarked on Project Sand Dollar, an initiative to issue a digital representation of the Bahamian dollar (B$). This innovative venture aimed to bridge the gap between unbanked and underbanked communities, providing them with regulated access to payment and financial services. Simultaneously, the introduction of this retail central bank digital currency (CBDC) was expected to reduce service delivery costs and enhance transactional efficiency across the nation.

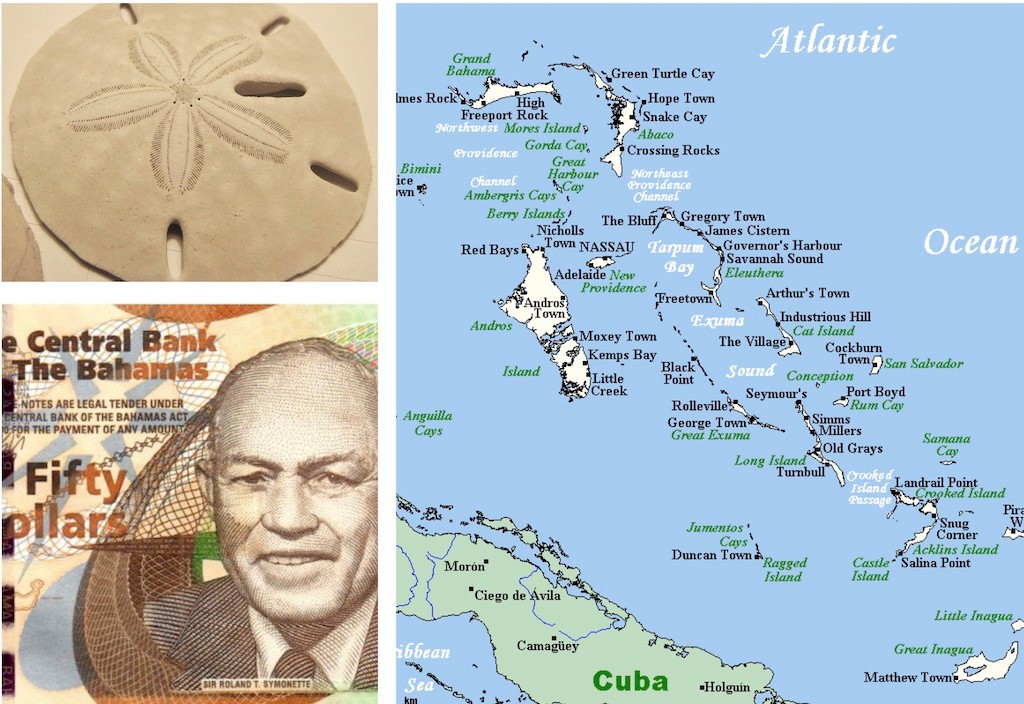

The initiative’s name, Project Sand Dollar, was the result of an online competition. The winning name, Sand Dollar, was also adopted for the digital currency itself. Unlike cryptocurrencies like Bitcoin, which are decentralized and unregulated, Sand Dollar was a central bank digital currency (CBDC). This designation meant that Sand Dollar was a centralized, regulated, stable, private, and secure unit of account and means of exchange. The digital B$ was directly backed by the Central Bank of The Bahamas’ foreign reserves, providing a tangible asset to support its value.

Cryptocurrencies, on the other hand, were typically issued or minted by private entities. While they may reference or be backed by other assets, including central bank currencies, they did not represent the liability of any government or central authority. In some cases, cryptocurrencies were not even backed by any underlying asset, raising concerns about their stability and value.

The introduction of Sand Dollar marked a significant step forward for The Bahamas, enhancing financial accessibility and efficiency while maintaining a strong regulatory framework. This trailblazing initiative set a precedent for other countries exploring the potential of CBDCs to transform their financial landscapes.