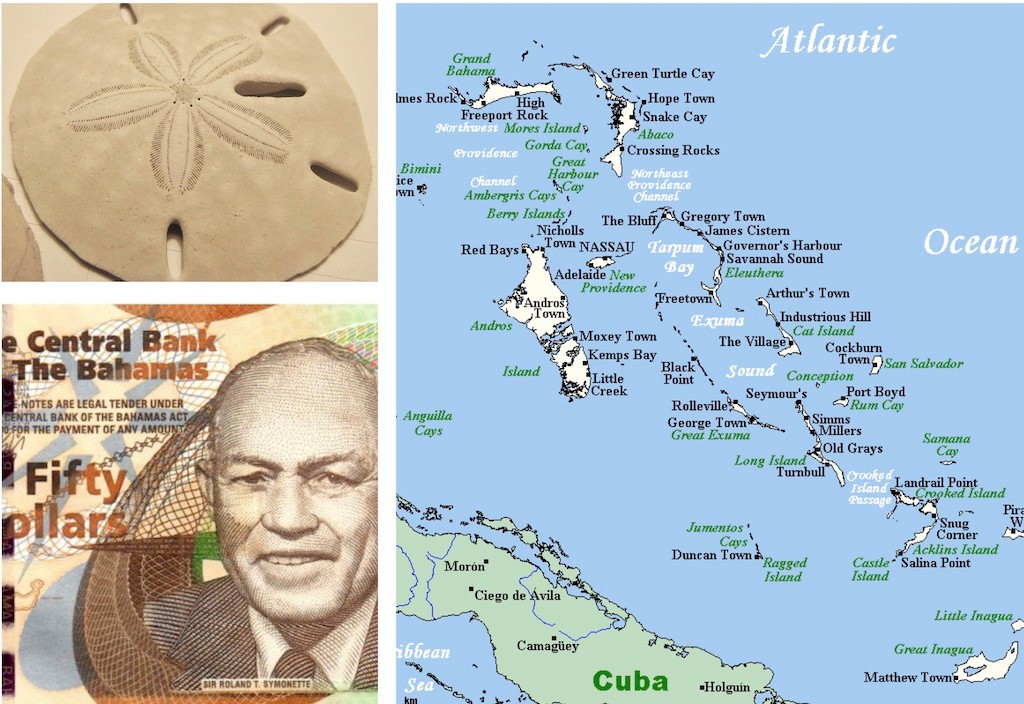

In the realm of finance, innovation is constantly evolving, and the introduction of digital currencies marks a significant leap forward. The Central Bank Digital Currency (CBDC) project, under the name Sand Dollar, is set to revolutionize the way Bahamians interact with their finances.

Tailored for Every User

Sand Dollar is designed with a user-centric approach, offering a flexible and secure digital currency experience that caters to individuals and businesses alike. The Central Bank has outlined a comprehensive framework that outlines the different transaction limits and user categories for Sand Dollar.

Individual Users:

For individuals, basic due diligence will enable individuals to maintain a maximum holding capacity of $500 and conduct monthly transactions totaling $1,500. Enhanced due diligence, involving more stringent identification and verification measures, will allow individuals to hold up to $5,000 and conduct transactions worth $10,000 per month. Additionally, personal wallets connected to deposit accounts will have access to higher transaction values, ensuring seamless integration with traditional financial systems.

Business Users:

Non-individual Sand Dollar wallet holders, primarily businesses, will have broader transaction limits. With basic due diligence, businesses can maintain total balances of $8,000 or 1/20th of their annual sales receipts, subject to a maximum ceiling of $1 million. Monthly transaction limits of 1/8th of annual sales or $20,000, whichever is greater, will also apply.

Central Bank SFIs:

Central Bank SFIs, such as banks and other financial institutions, will not face any restrictions on Sand Dollar holdings as these balances will be interchangeable with the clearing balances they maintain with the Central Bank.

Streamlined Wallet Establishment

The Sand Dollar wallet establishment process is designed to be simple and seamless, leveraging the Central Bank’s established procedures and collaborating with banks, payment service providers, and mobile technology businesses. Users can initiate the process through various channels, including banks, payment service providers, or mobile technology businesses.

Card-Based Option for Non-Digital Users

Recognizing that not everyone is comfortable with digital platforms, the Central Bank is piloting a card-based version of the Sand Dollar wallet. This option will cater to users who prefer a more traditional means of accessing their digital currency funds. Cardholders will be able to check their wallet balances at point-of-sale devices.

A Secure and Innovative Path Forward

The Sand Dollar initiative marks a significant step in the evolution of Bahamian finance. With its tailored user categories, comprehensive transaction limits, and user-friendly wallet establishment process, Sand Dollar is poised to revolutionize the way Bahamians interact with their finances. The introduction of Sand Dollar reflects the Central Bank’s commitment to innovation and its dedication to providing Bahamians with a secure and accessible digital currency experience.

The Future of Finance: Sand Dollar’s Potential Impact

The introduction of Sand Dollar has the potential to transform the Bahamian financial landscape in several significant ways.

Economic Growth and Inclusion:

Sand Dollar can facilitate greater financial inclusion by providing access to digital financial services for those who are currently unbanked or underbanked. This could lead to increased economic activity and opportunities, particularly in underserved communities.

Enhanced Efficiency and Cost Savings:

Sand Dollar’s digital infrastructure can streamline financial transactions and reduce costs for both individuals and businesses. This could lead to increased efficiency and competitiveness in the Bahamian economy.

Cross-Border Payments and Trade:

Sand Dollar’s ability to facilitate cross-border payments could streamline international trade and investment, making it easier for Bahamian businesses to connect with the global market.

Enhanced Security and Transparency:

The Central Bank’s oversight of Sand Dollar ensures a high level of security and transparency for users. This can help to protect consumers and promote trust in the digital currency system.

A Sustainable and Resilient Financial System

Sand Dollar can help to strengthen the resilience of the Bahamian financial system by providing a secure and readily available alternative to traditional currencies. This could help to mitigate the impact of economic shocks and promote financial stability.

Advancing Innovation and Leadership:

The successful implementation of Sand Dollar can position the Bahamas as a leader in the adoption of central bank digital currencies. This could foster further innovation and attract investment in the country’s financial sector.

Conclusion

The Sand Dollar initiative is a bold and transformative step for the Bahamas. With its potential to enhance financial inclusion, promote economic growth, and strengthen the financial system, Sand Dollar has the power to shape the future of finance in the country. As the Central Bank continues to refine and roll out Sand Dollar, the Bahamas is poised to become a pioneer in the realm of digital currencies, paving the way for a more inclusive, efficient, and secure financial future for its citizens.