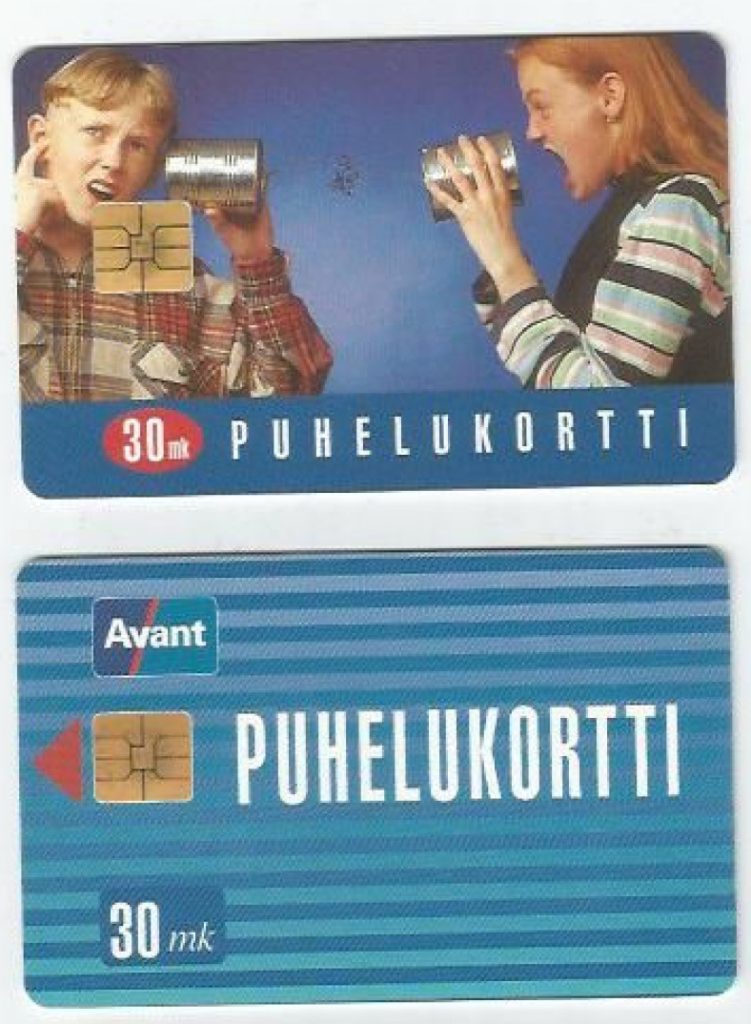

In 1997, a significant milestone was achieved in Finland with the successful integration of the Avant card system into the existing ATM network. This achievement, however, was no small feat, given the technical complexities involved in adapting the aging ATMs, which were originally designed around magnetic stripe technology, to accommodate the innovative Avant cards.

The process of retrofitting these machines to incorporate a separate card slot for smart cards posed a unique set of challenges. Customers often found themselves grappling with confusion over which card slot to use, as smart cards, including the Avant, were gradually making their way into the realm of debit and credit transactions. Despite these challenges, the transition towards smart card technology marked a progressive shift, even though it would take nearly a decade for these cards to fully supplant their magnetic counterparts.

To enhance user experience, banks introduced combined cards that consolidated the functions of Avant, debit, and credit onto a single physical card. One notable advantage of utilizing the pre-funded Avant feature was its ability to facilitate offline transactions without the need for authentication. In this regard, Avant payments embodied a cash-like convenience, particularly when compared to the more intricate processes associated with debit or credit card transactions.

The rise of e-money cards, exemplified by Avant, was initially anticipated to herald the demise of physical cash. Industry experts and banking institutions foresaw a future where e-money would swiftly replace cash transactions within a few short years. This expectation was driven by the belief that electronic payment solutions would significantly reduce the costs associated with handling cash, particularly in terms of storage and logistics.

Predictions from the late 1990s and early 2000s envisioned a landscape where coins and even smaller denomination banknotes would be phased out in favor of electronic payment instruments. However, these forecasts proved to be overly optimistic, as cash continues to maintain its widespread usage today. Contrary to initial projections, electronic payments, particularly credit and debit card transactions, emerged as the primary contenders challenging the dominance of traditional cash transactions in the modern financial ecosystem.