In a trailblazing study article from the International Journal of Economic Policy Studies, Huseyin Oguz Genc and Soichiro Takagi thrust the ever-evolving discourse on central bank digital currencies (CBDCs) into the spotlight. Their work questions the feasibility of private digital currencies coexisting harmoniously with a central bank digital currency, drawing on historical precedents that hint at the eventual nationalization and regulation of competing currencies.

A Global Movement: CBDCs in the Wake of Covid-19

The literature review presented in the article identifies the fundamental determinants of research pertaining to the design and implementation of CBDCs. One key revelation is the global surge in interest and momentum for CBDC implementation, catalyzed by the seismic impact of the COVID-19 pandemic and the proliferation of alternative digital currencies.

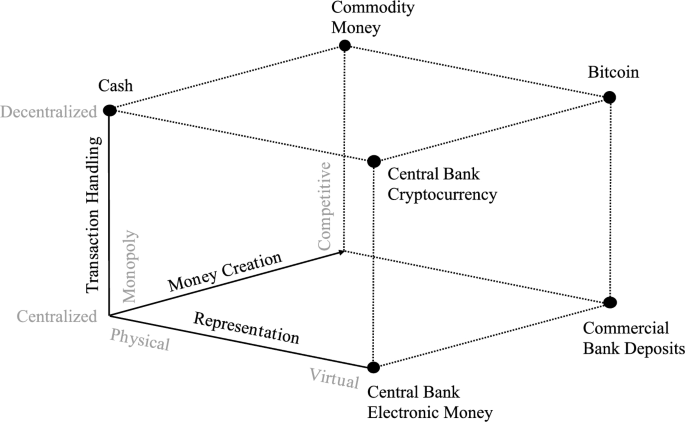

CBDCs, in their simplest form, are digital representations of traditional cash, embedded within a novel technical architecture. The comprehensive findings are categorized into three distinct approaches: generic research, mainstream central banking, and alternative research methodologies.

Generic Research on CBDCs: Weighing Benefits, Risks, and Costs

The generic research approach delves into standard design features, offering a thorough analysis of the benefits, risks, and costs associated with CBDCs. This section lays the foundation for understanding the implications of CBDCs at a macroeconomic level.

Mainstream Central Banking Approach: Macro Policy and Financial Stability

A survey of mainstream publications reveals the theoretical macro policy and financial stability discussions surrounding CBDCs. This comprehensive exploration is complemented by a review of alternative research methods, introducing diverse perspectives to broaden the discourse.

Alternative Research Approaches: Diversifying Opinions and Practical Implications

Alternative research methods seek to diversify the scope of opinions on CBDCs. Case studies are employed to identify practical implications, endorsing a comprehensive and unbiased approach that exposes shortcomings within the existing literature.

The Critical Findings: Navigating Shortcomings and Concerns

The authors of this groundbreaking review advocate for a comprehensive and unbiased approach to identify shortcomings and concerns within the rapidly expanding literature on CBDCs and their design implications.

Achieving Benefits Without CBDCs

Ample evidence surfaces, suggesting that governments can realize most purported benefits without the implementation of CBDCs. This reality is already evident in certain jurisdictions. The results further highlight privacy, security, and social risks associated with the implementation of retail CBDCs, necessitating systematic research on public opinion.

Preferred Design Choices and Implementation Challenges

The analysis makes a significant contribution by pinpointing preferred design choices as the global implementation of CBDCs looms on the horizon. The wholesale distribution model gains favor for early implementation stages, mitigating disruptions to the financial system. However, no consensus emerges between wholesale and retail CBDCs, with the latter attracting substantial research interest among central bankers.

Technical and Social Benefits: Existing Technologies vs. CBDCs

The purported benefits of CBDCs, including financial inclusion and enhanced payment system efficiency, are challenged by tangible evidence that existing financial technologies can already fulfill these functions. Security concerns emerge, with large-scale cyberattacks potentially eroding trust in digital public money networks.

Macro Policy Considerations: Navigating Monetary and Fiscal Impacts

The macro policy considerations focus on expected monetary and fiscal policy benefits. Two standout studies propose the introduction of programmable helicopter money, enabling direct payments to households. Another anticipated gain is the implementation of negative nominal interest rates, with potential benefits during financial turmoil.

Eliminating Cash: Disruptive Potential and Political Challenges

A radical outcome of CBDCs is the potential elimination of cash, a move that many argue would be politically challenging due to privacy concerns. Despite potential benefits, such as limiting tax evasion and improving anti-money laundering (AML) standards, the elimination of cash could lead to higher adoption of private digital currencies, increasing currency substitution in weaker economies.

Blurring Lines: Fiscal and Monetary Policy Conundrums

The far-reaching implications of CBDCs raise concerns about the increasing obscurity of the separation between fiscal and monetary policies. There is a palpable fear that the independence of central banks may be undermined, entangling them in politics over the long term.

In conclusion, the groundbreaking review by Genc and Takagi offers a panoramic view of the multifaceted landscape surrounding CBDCs. As governments and financial institutions grapple with the potential implementation of these digital currencies, the need for comprehensive research, public dialogue, and a nuanced understanding of both benefits and risks becomes increasingly evident. The article serves as a beacon, guiding the way through the labyrinthine complexities of the digital currency revolution.

Reference:

https://link.springer.com/article/10.1007/s42495-023-00125-9