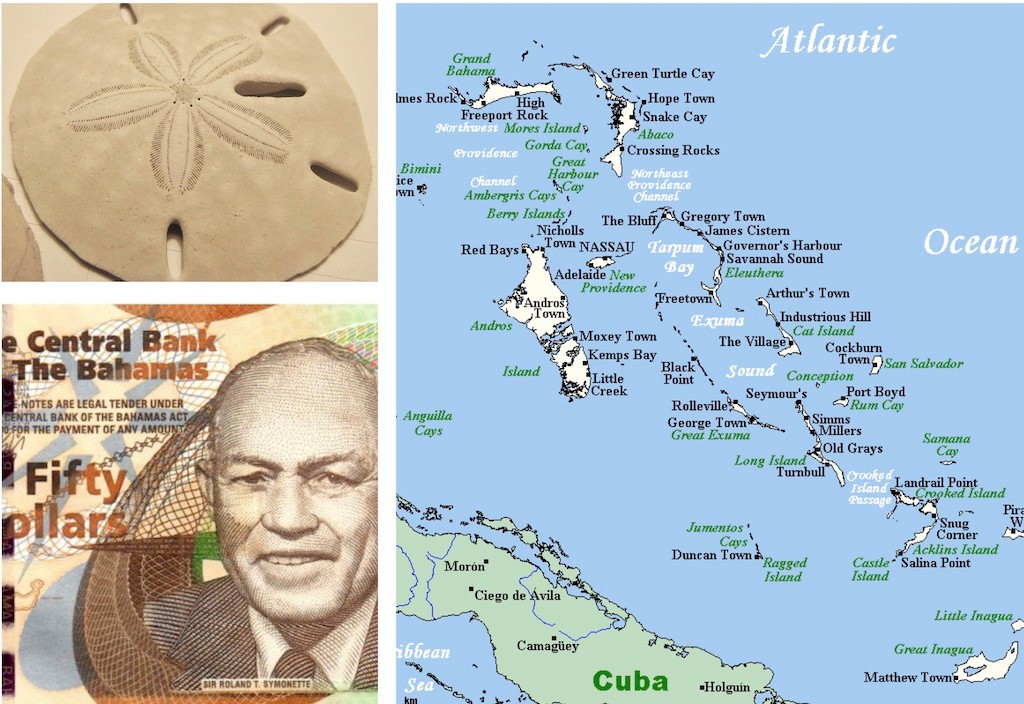

In a groundbreaking move towards financial innovation, The Bahamas is set to rewrite the narrative of digital currencies with the introduction of the Sand Dollar since 2018. The Central Bank, in its pursuit of a modern financial landscape, embarked on an exhaustive journey to select a technology solutions provider capable of navigating the archipelagic challenges while adhering to international regulatory standards. The chosen architect of this digital transformation was none other than NZIA Limited, marking a pivotal moment in the nation’s financial evolution.

The Genesis of the Sand Dollar

March 2019 saw the unveiling of a comprehensive digital fiat solution, carefully crafted to address the unique challenges of The Bahamas. Key among these was achieving interoperability among existing and new channels, enabling all payment service firms access to the Sand Dollar Network for the settlement of retail Bahamian dollar payments. This move promotes inclusivity in the financial sector, ensuring that all players can leverage the digital currency for the benefit of the entire economy.

A notable feature that distinguishes the Sand Dollar is its “offline functionality,” a safeguard against communication disruptions between islands. Users can make pre-set dollar value payments during such downtimes, with the system automatically updating once communication is restored, ensuring a seamless financial experience even in adverse conditions.

Real-Time Revolution

The Sand Dollar boasts near-instantaneous validation of transactions, revolutionizing the pace of financial operations. This real-time transaction processing is further complemented by point-of-sale support for businesses. Through tailored solutions, businesses can process payments using modern credit and debit card machines or mobile phone apps, aligning the financial ecosystem with global standards.

Fortifying Security Measures

In the era of digital finance, security is paramount. The Sand Dollar doesn’t compromise on this front, incorporating multi-factor authentication for wallet users. To complete certain payment transactions, users must provide two passcodes, one of which is randomly generated, adding an extra layer of protection against unauthorized access.

The system also ensures a fully auditable transaction trail, adhering to strict regulatory standards. While user confidentiality is a priority, robust monitoring for fraud detection further fortifies the Sand Dollar against illicit activities.

Bridging Domestic and International Frontiers

The Sand Dollar is resolute in its commitment to domestic use, with strict restrictions on acceptance by non-domestic payees. However, through Payment Service Providers (PSPs), users have the option to integrate their accounts with commercial banks, facilitating electronic purchases of foreign exchange and enabling the use of their accounts internationally.

From Wholesale to Retail: The Inclusive Approach

The Sand Dollar’s versatility extends beyond the conventional financial realms. With both wholesale and retail applications, it caters to the intricacies of inter-bank settlements and general public transactions. Each Sand Dollar holder maintains direct claims on the Central Bank, establishing legal equivalence to holding accounts with the country’s financial cornerstone.

The Pilot Phase: Testing the Waters

Before the Sand Dollar becomes a staple in The Bahamas, a thorough pilot phase is set in motion. Beginning in Exuma in December 2019 and expanding to Abaco in the first half of 2020, this phase aims to ensure the seamless functionality of all facets of the digital system. Abaco, in particular, will serve as a testing ground for emergency wireless communications features, a crucial element for rapid financial services recovery following natural disasters.

The Sand Dollar journey is not merely a technological upgrade; it symbolizes The Bahamas’ commitment to financial inclusivity, technological resilience, and global relevance. As the world watches, The Bahamas stands poised on the precipice of a new era in finance, where the Sand Dollar could well be the harbinger of transformative change.

Embracing the Future: The Expansion of Sand Dollar

As The Bahamas ushers in the Sand Dollar era, the nation is poised at the forefront of digital innovation in the financial sector. The pilot phase, set to unfold in Exuma and Abaco, is not just a technical trial; it’s a strategic move to ensure that every aspect of this groundbreaking system aligns seamlessly with the needs and challenges unique to The Bahamas.

Abaco: A Crucial Testing Ground

The decision to expand the pilot to Abaco reflects a forward-thinking approach. Abaco’s setting will not only test the technical capabilities of the Sand Dollar but will also serve as a critical experiment in emergency wireless communications features. In a region susceptible to natural disasters, the ability to maintain financial services even in the aftermath of such events is a testament to the resilience that the Sand Dollar aims to bring to the nation.

The connectivity with Abaco’s retail businesses during their early recovery process underscores the commitment to economic revitalization in times of crisis. It’s not merely about transactions; it’s about financial empowerment in the face of adversity.

Security Measures: Safeguarding Financial Frontiers

In an era where cyber threats loom large, the Sand Dollar’s multi-factor authentication and fully auditable transaction trail instill a sense of confidence. As the digital realm evolves, the Sand Dollar ensures that security is not compromised. The system strikes a delicate balance between transparency and confidentiality, adhering to stringent regulatory standards while leveraging modern technology for fraud detection.

International Integration through PSPs

While the Sand Dollar is primarily designed for domestic use, its integration with Payment Service Providers (PSPs) opens a gateway to international transactions. Users, through these providers, can seamlessly navigate the global financial landscape. This approach not only facilitates international purchases but also positions The Bahamas on the world stage as a player in the digital finance arena.

Digital ID Solution: KYC and Beyond

One of the distinguishing features of the Sand Dollar is its integration of a Digital ID solution. This isn’t just a technological add-on; it’s a strategic move that incorporates Know Your Customer (KYC) and identity features into the very fabric of the system. As the financial services sector explores this Digital ID solution, it paves the way for streamlined processes and enhanced security, setting a precedent for future innovations in the industry.

Wholesale and Retail Applications: Democratizing Finance

The dual applications of the Sand Dollar, catering to both wholesale and retail needs, showcase a commitment to financial inclusivity. By providing direct claims on the Central Bank to every holder, the Sand Dollar brings a democratizing force to finance. It’s not just about facilitating transactions; it’s about empowering individuals and businesses, large and small, in their financial endeavors.

The Road Ahead

As the Sand Dollar embarks on its journey through the pilot phase, The Bahamas stands as a beacon of financial evolution. The world watches with anticipation as the nation navigates the complexities of modernizing its financial landscape while preserving its unique economic and geographical identity.

The success of the Sand Dollar isn’t just measured in its technical functionalities; it’s measured in the impact it has on the lives of Bahamians. It’s about providing financial services that are resilient, inclusive, and forward-thinking. The Sand Dollar isn’t just a digital currency; it’s a symbol of The Bahamas’ readiness to embrace the future of finance. And as the pilot phase unfolds, it paves the way for a new chapter in the global narrative of digital currencies—one where The Bahamas leads the way.