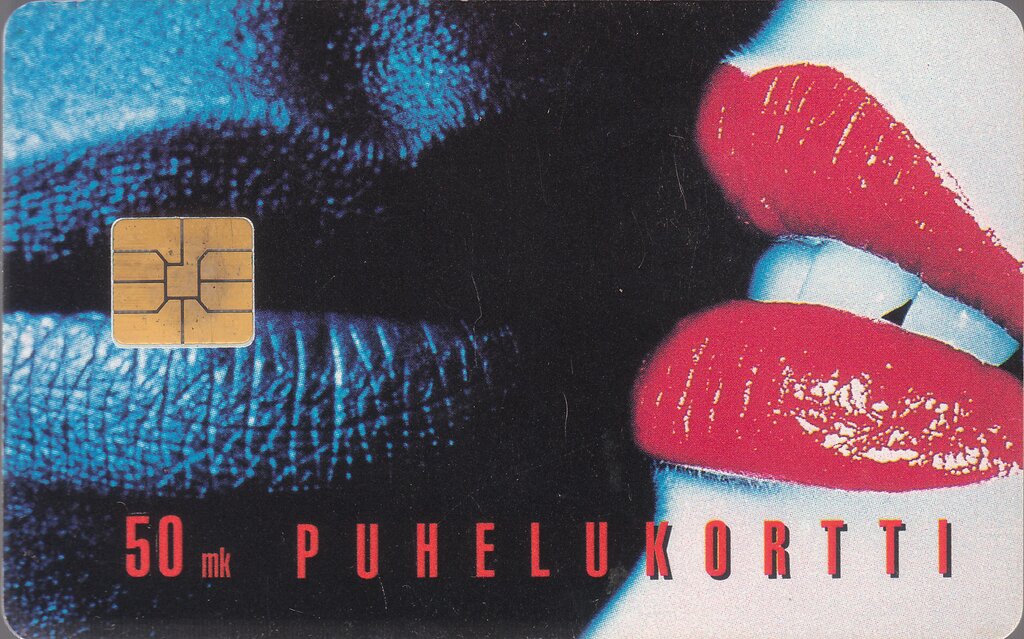

In 1991, the Bank of Finland unveiled an audacious plan for a central bank-issued electronic money system, dubbed “Avant.” This visionary proposal aimed to revolutionize the payment landscape by introducing a digital equivalent of cash, emulating its ease of use, anonymity, and widespread acceptance.

Key Design Principles

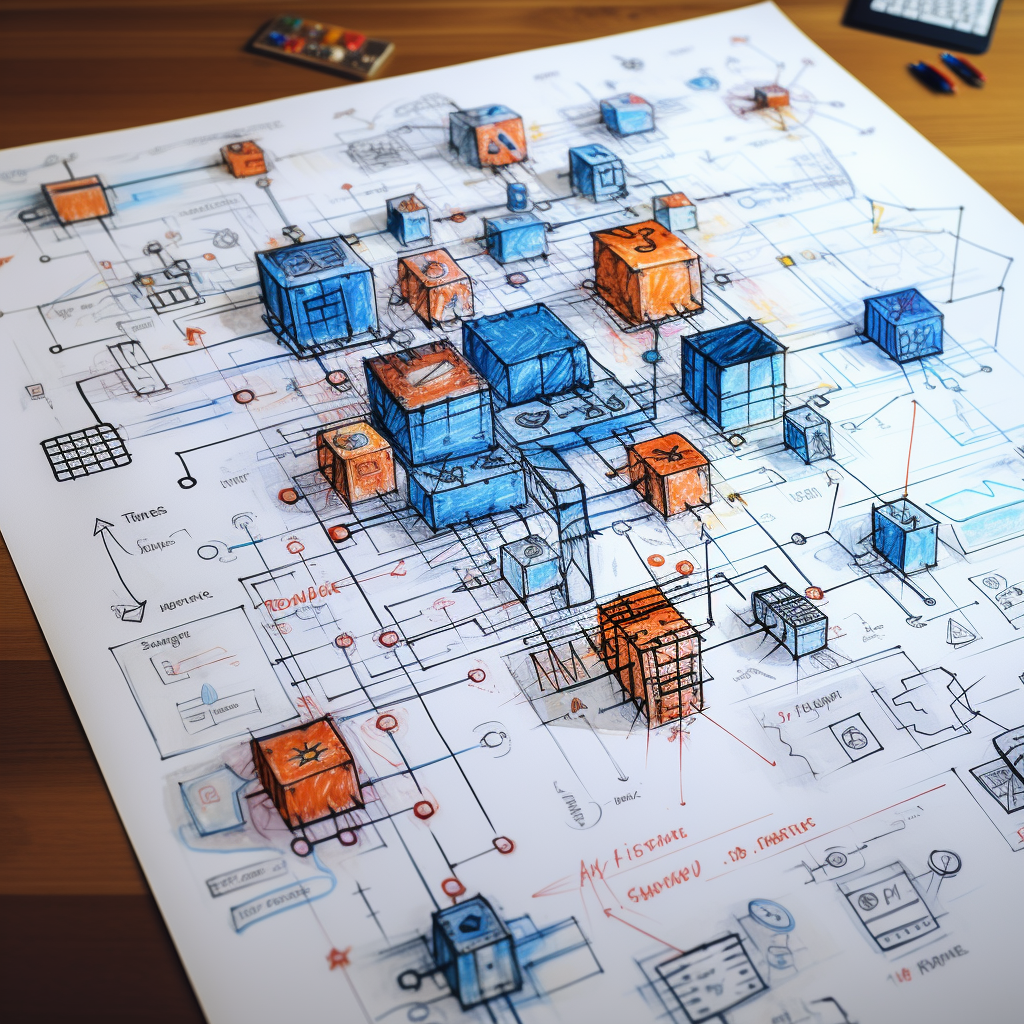

The Avant plan outlined four fundamental design objectives:

General Acceptance: The payment instrument should be readily accepted by a vast network of merchants, enabling its use in a multitude of contexts.

Anonymity: Cardholders would remain untraceable during transactions, with no transaction data recorded or linked to individual users. Only card balances would be maintained, ensuring privacy.

Efficiency: The system’s primary goal was to reduce costs, ensuring seamless operation and user-friendly functionality.

Safety: Funds held on Avant cards would be absolutely secure, backed by the full authority of the central bank.

A Pioneering Approach

The Avant plan’s emphasis on mirroring the characteristics of cash highlighted its innovative approach to electronic payments. By storing monetary value directly on the card, the system eliminated the need for intermediary bank accounts, enhancing flexibility and efficiency.

Merchants would accept Avant payments seamlessly, simply swiping the card through their terminals. Transaction amounts would be deducted from the card’s balance and credited to the terminal’s balance, ensuring real-time settlement.

At regular intervals, merchants would redeem their accumulated balances from the Avant issuer, directly transferring the equivalent amount to their bank accounts.

Privacy Protection

To safeguard user privacy, the Avant system would not track individual transactions. Instead, only balances would be adjusted after each transaction, preserving the anonymity associated with cash-based payments.

Beyond Immediate Payments

The Avant plan’s impact extended beyond the immediate payment experience. It encompassed considerations such as seigniorage income, a central bank’s profit from issuing currency, and the potential impact on monetary policy transmission and financial stability.

A Milestone in CBDC Exploration

While the Avant project never reached full implementation, it marked a significant milestone in the exploration of central bank digital currencies (CBDCs). Its principles and design considerations continue to shape the development of modern and future CBDC initiatives worldwide.

The foresight displayed by the Bank of Finland in envisioning a digital form of cash decades ago exemplifies its commitment to technological innovation and its dedication to meeting the evolving financial needs of society.