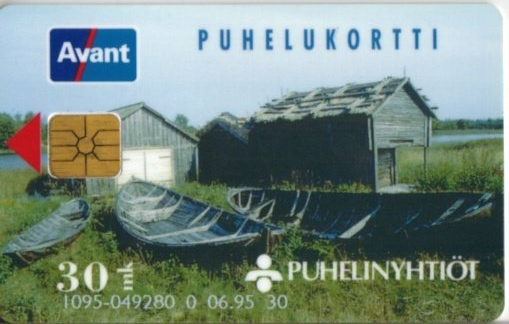

The Avant card, a pioneering electronic cash system launched by the Bank of Finland in the early 1990s, underwent a significant transition in its third year of operation. Recognizing the potential for commercial expertise and the need to streamline its responsibilities, the central bank decided to spin off Avant and sell it to private actors. This decision marked a departure from the traditional role of central banks in managing payment systems, signaling a shift towards a more collaborative approach.

The decision to privatize Avant was driven by several factors. Firstly, the central bank believed that its long-term involvement was unnecessary and potentially counterproductive. While the initial establishment of the system aligned with its mandate, it was deemed that ongoing direct management would not bring the desired outcomes. Instead, the central bank opted to focus on its core functions, such as overseeing the payment system and contributing to industry standards, while handing over the operational aspects to commercial entities.

The search for a suitable buyer led to the consideration of merging Avant with an automated teller machine (ATM) business. Finland’s major retail banks had already established a joint venture to create a nationwide ATM network. This presented an opportunity to integrate Avant’s card-issuing capabilities with the ATM infrastructure, streamlining the reload process and expanding the accessibility of the electronic cash system.

The negotiations between the Bank of Finland, the ATM consortium, and the commercial banks were not without challenges. The primary point of contention revolved around the financial distribution of costs and benefits arising from the operation of the combined system. This impasse temporarily halted the process, prompting the consortium of commercial banks to explore developing an alternative system.

After overcoming these hurdles and reaching an agreement, the transaction was finalized in late 1995. The rationale behind the sale was twofold: to consolidate the Avant card-issuing business with the ATM operation and to leverage the existing customer relationships of the commercial banks. This move aimed to enhance the user experience, expand the reach of the electronic cash system, and potentially pave the way for further integration with other financial services.

The Avant card’s journey from a central bank-led initiative to a commercial enterprise highlights the evolving role of central banks in the digital payment landscape. While they retain a crucial supervisory function, they are increasingly recognizing the value of partnerships with commercial entities to optimize payment systems and enhance user experiences. The Avant case study serves as an example of this collaborative approach, demonstrating how central banks can effectively navigate the transition towards a more market-driven payment system.