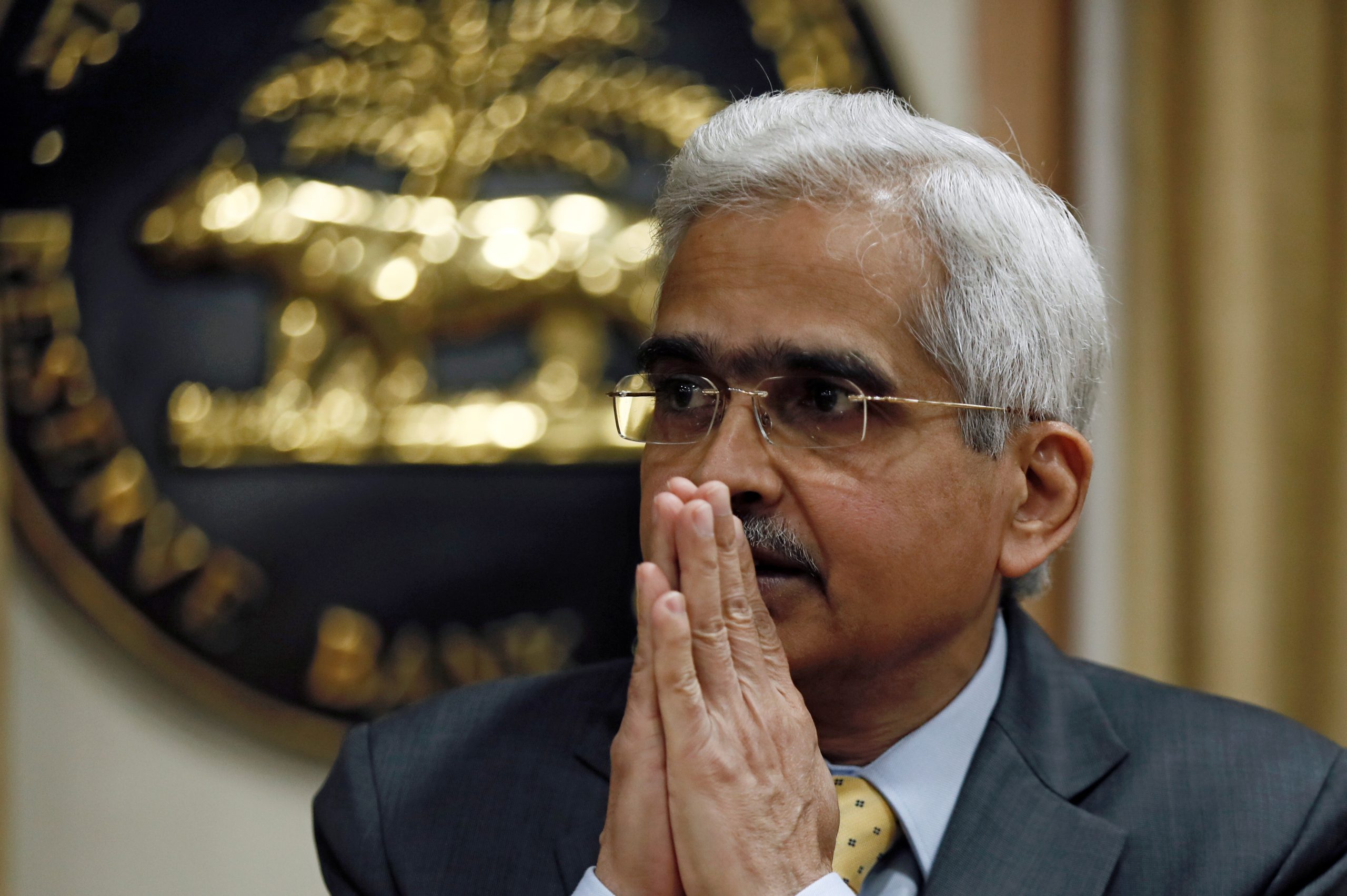

In a momentous announcement that reverberated through the corridors of global finance, RBI Governor Shaktikanta Das unveiled ambitious plans for the Reserve Bank of India’s foray into the realm of Central Bank Digital Currency (CBDC). From the hallowed halls of the BIS Innovation Summit 2024 in Basel, Switzerland, Governor Das charted a course towards a future where digital currencies seamlessly integrate into the fabric of everyday transactions, propelling India into a new era of financial innovation and inclusivity.

One of the pivotal aspects of the RBI’s CBDC initiative is the exploration of offline transferability, a feature designed to replicate the convenience of cash transactions even in the absence of internet connectivity. This offline capability, Governor Das emphasized, represents a significant leap forward in promoting financial inclusion, particularly in regions with limited digital infrastructure. Furthermore, the integration of programmability features seeks to revolutionize the dynamics of digital transactions, fostering a more seamless and efficient payment ecosystem.

Governor Das articulated the RBI’s commitment to addressing concerns surrounding CBDC’s potential impact on traditional banking models. By ensuring that CBDCs remain non-remunerative and non-interest bearing, the RBI aims to mitigate any risks of disintermediation, safeguarding the stability of the banking sector. Moreover, Governor Das highlighted the imperative of comprehensively assessing the economic ramifications of CBDC adoption, particularly in terms of its implications for monetary policy and financial intermediation.

The RBI’s endeavor to bolster retail transactions through CBDC mirrors the resounding success achieved by the Unified Payments Interface (UPI) in revolutionizing digital payments in India. Despite reaching a commendable milestone of one million daily transactions, CBDC uptake still lags behind instant mobile payment modes. Governor Das expressed optimism about the prospect of leveraging CBDCs for diverse financial instruments, including commercial papers and certificates of deposits, to stimulate greater consumer engagement.

The integration of CBDC with existing fast-payment systems like UPI represents a pivotal step towards streamlining digital transactions and enhancing user accessibility. By enabling a single QR code for both UPI and CBDC payments, the RBI aims to simplify the payment process for businesses and consumers alike, fostering widespread adoption of digital currency solutions.

In tandem with its CBDC endeavors, India has witnessed a remarkable surge in the adoption of the digital rupee, showcased through the successful implementation of the e-Rupee pilot program launched in December 2022. With over 1.3 million customers and 300,000 merchants participating in the program, India has emerged as a trailblazer in digital currency experimentation. However, despite the commendable progress, retail adoption of digital currency remains at 35%, highlighting the need for concerted efforts to expand its usage among the broader population.

Governor Das’ vision for CBDC represents a paradigm shift in India’s monetary landscape, positioning the country at the forefront of digital currency innovation. While acknowledging the challenges ahead, Governor Das expressed confidence in the transformative potential of CBDC to redefine financial systems and empower individuals across diverse socioeconomic strata. As India continues its journey towards a cashless future, the RBI’s unwavering commitment to technological advancement underscores its pivotal role in shaping the digital economy of tomorrow.

Reference: https://www.youtube.com/watch?v=x7uweyAO_Vk