In a world where financial systems are constantly evolving, the Hong Kong Monetary Authority’s (HKMA) announcement last year about the imminent launch of the mBridge DLT solution for cross-border payments stirred significant anticipation. However, recent developments, particularly the BIS’s cautious stance on the timeline, have added layers of complexity to an already intricate narrative.

The Collaborators:

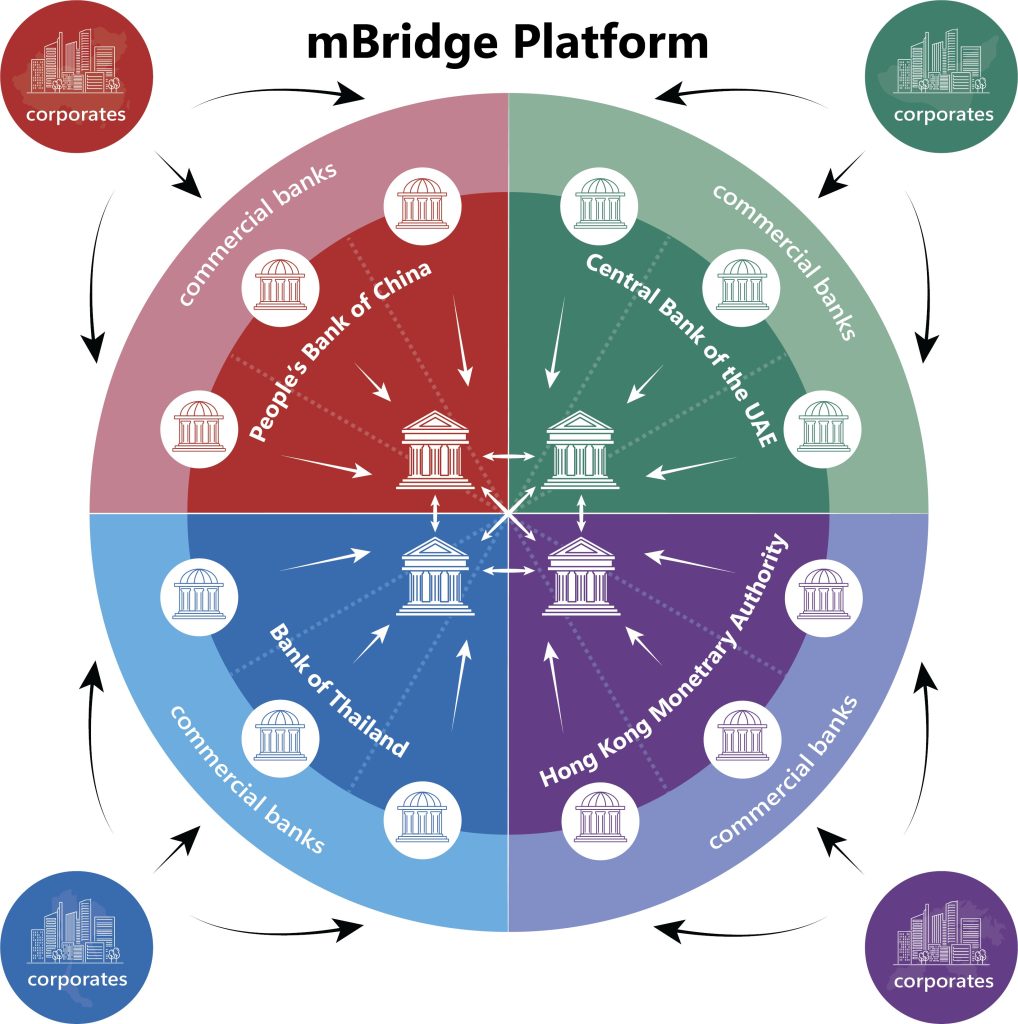

The mBridge initiative boasts a formidable lineup of collaborators, with the central banks of China, Thailand, and the UAE joining forces. Additionally, twenty-three central banks and the International Monetary Fund (IMF) are closely observing the project’s progress. The geopolitical implications of such a collaboration are profound, as mBridge could potentially challenge the dominance of Swift in cross-border payments and influence the global role of the U.S. dollar.

China’s Strategic Move:

China’s involvement in mBridge aligns with its broader strategy to diversify cross-border payments. Despite having the Cross-Border Interbank Payment System (CIPS), the dollar continues to wield significant influence in international transactions. Recent statistics reveal a 23% growth in the usage of the Chinese Renminbi (RMB) in cross-border transactions during the first nine months of the previous year. This shift is crucial for China, aiming to reduce its reliance on the dollar, especially in regional transactions where the U.S. is not directly involved.

The Role of BIS:

The involvement of the Bank for International Settlements (BIS), known as the central banker for central banks, adds a layer of controversy to mBridge. With its Innovation Hub, the BIS has been collaborating with various central banks globally. However, the decision to engage with mBridge might have prompted internal debates, especially considering the potential geopolitical implications. As a global coordinator among central banks, the BIS’s participation in mBridge raises questions about its role in shaping the future of cross-border payments.

Timeline Uncertainties:

While the HKMA has been optimistic about the launch of the mBridge MVP and its path to commercialization, the BIS has taken a more reserved stance. The CEO of the HKMA, Eddie Yue, has provided timelines, stating that the MVP would pave the way for the gradual commercialization of mBridge. However, the BIS’s updates have been more guarded, acknowledging that the next envisaged stage is to see if the platform can evolve into a Minimum Viable Product.

The Enigma of the MVP:

Cecilia Skingsley, the head of the BIS Innovation Hub, emphasized the complexity of the project during a recent media briefing. While confirming that the MVP is part of the current Phase 3, she refrained from committing to a specific timeline due to outstanding issues. The decision on whether mBridge progresses to the next phase will depend on the lessons learned and discussions with partner central banks. The complexity of the decision-making process is amplified by the involvement of China’s Digital Currency Research Institute, responsible for developing the technical solution.

Potential Roadblocks:

As mBridge approaches the pivotal decision point, questions arise about the potential roadblocks. If the BIS Innovation Hub suggests that mBridge should not proceed, but one or more central banks wish to continue, the project’s fate hangs in the balance. The involvement of the BIS is seen by some as a necessary component for success, but conflicting interests and geopolitical tensions could pose challenges.

Challenges on the Horizon:

The road ahead for mBridge is fraught with challenges that extend beyond technical complexities. The geopolitical landscape, already tense, adds an additional layer of uncertainty. The potential for mBridge to challenge the existing order in cross-border payments has not gone unnoticed, and skeptics question whether it could truly become a viable alternative to Swift.

Geopolitical Implications:

The geopolitical implications of mBridge’s success are significant, especially in the context of China’s efforts to reduce its reliance on the U.S. dollar. If mBridge gains traction, it could potentially shift the balance of power in international finance. This has caught the attention of global players, including the United States, which may view the involvement of the BIS in mBridge with suspicion.

The Role of BIS in a Changing Landscape:

The BIS, as the central banker for central banks, faces a delicate balancing act. Its role in mBridge could be seen as an attempt to stay ahead of the curve in a rapidly evolving financial landscape. The Innovation Hub, a relatively new venture, is being put to the test with mBridge, a project that could redefine the future of cross-border transactions.

Cautious Optimism or Skepticism?

As the project progresses, the contrasting tones between the statements from the HKMA and the BIS raise questions about the alignment of objectives among the project partners. While the HKMA expresses confidence in the imminent launch of the MVP and the subsequent commercialization of mBridge, the BIS appears to exercise caution, acknowledging the need to address outstanding issues before committing to a timeline.

The Unpredictable Future:

The question of what a production project of mBridge would look like remains unanswered. Mrs. Skingsley’s analogy of a supervisory tool highlights the intricate decisions that need to be made about the project’s real-world application. Whether mBridge will be adopted by a coalition of central banks, supervisory authorities, or even offered as a commercial tool to the private sector is uncertain, and the decision-making process may involve input from various stakeholders.

The journey of mBridge unfolds as a narrative that combines technological innovation, geopolitical complexities, and financial aspirations. The decision on the MVP’s launch and the subsequent commercialization could shape the future of cross-border payments. As the project navigates through the intricacies of global finance, stakeholders, including central banks and the BIS, face the challenge of finding common ground amid geopolitical tensions. The true impact of mBridge on the international financial system remains an enigma, and the world watches with bated breath to see whether this ambitious initiative will revolutionize cross-border transactions or remain a captivating but unrealized vision.

Reference:

https://www.hkma.gov.hk/media/eng/doc/key-functions/financial-infrastructure/mBridge_publication.pdf

http://www.pbc.gov.cn/goutongjiaoliu/113456/113469/5108112/index.html

https://www.hkma.gov.hk/eng/news-and-media/speeches/2023/09/20230922-1/