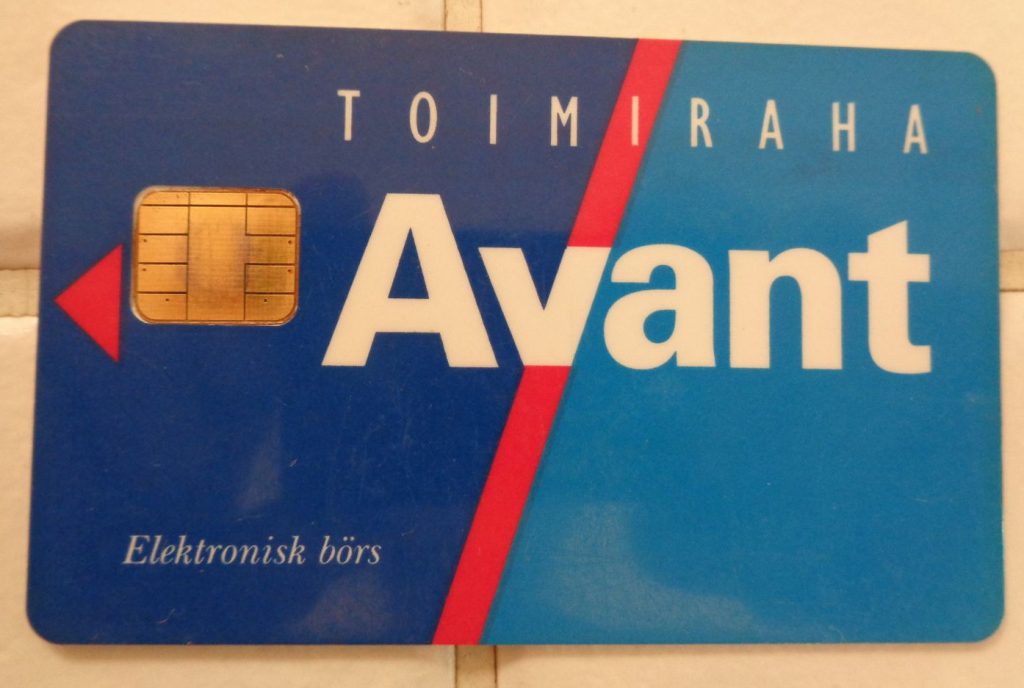

In the annals of monetary history, the Avant Card stands as a remarkable experiment, a precursor to the modern concept of central bank digital currencies (CBDCs). Launched in Finland in the early 1990s, Avant was a smart card-based payment system that stored and facilitated transactions using digital currency issued by the Bank of Finland. While Avant ultimately failed to gain widespread adoption, its legacy serves as a valuable case study for understanding the challenges and opportunities associated with CBDCs.

Avant’s Ambitious Goals

Avant was conceived as a means to modernize Finland’s payment landscape. The Bank of Finland envisioned a system that could replace cash for small transactions, particularly in the growing electronic commerce sector. Avant’s smart card technology promised to offer convenience, security, and anonymity, making it a compelling alternative to traditional cash payments.

Minimizing Monetary Policy Impact

The Bank of Finland carefully considered the potential impact of Avant on monetary policy. They concluded that, as a digital substitute for cash, Avant was unlikely to significantly alter the transmission of monetary policy signals. This was primarily due to the limited scope of Avant’s usage, which was primarily focused on small-value transactions.

The Seigniorage Quandary

At the time of Avant’s launch, interest rates were significantly higher than they are today. This made the question of seigniorage income, the profit earned by a central bank from creating new money, a crucial consideration. While Avant was expected to have some impact on seigniorage, due to its lower production costs compared to cash, the initial impact was considered negligible.

The Limited Appeal of Avant

Despite its innovative technology and promising potential, Avant failed to gain widespread adoption. Several factors contributed to its demise, including limited merchant acceptance, high transaction fees, and the emergence of more convenient and established payment methods, such as debit cards.

Avant’s Enduring Relevance

Despite its shortcomings, Avant’s legacy remains significant. It was the world’s first attempt to introduce a CBDC, paving the way for ongoing discussions and experimentation with this technology. Avant’s experience highlights the challenges of introducing new payment systems, particularly those that aim to displace established alternatives.

Learning from Avant’s Lessons

The history of Avant offers valuable lessons for policymakers and technology developers exploring the potential of CBDCs. The importance of widespread adoption, ease of use, and integration with existing payment infrastructure is paramount for any successful CBDC.

Avant’s story serves as a reminder that technological innovation alone is not enough to guarantee the success of a new payment system. Careful consideration of user needs, market dynamics, and regulatory frameworks is essential to ensure that CBDCs can fulfill their potential and revolutionize the way we make payments.